Alprofit Consult is an independent studio that provides accounting services, tax administration services and financial consulting services along with training services in these fields. We offer a full package of personalized professional services to businesses and individuals who wish to benefit from these services.

At AlProfit Consult, we are committed to ensuring that our clients have the resources they need to optimize their financial position and business operations. We welcome the opportunity to learn more about your financial service needs and how we can assist you.

We also invite you to benefit from our offer of providing financial consulting services free of charge for the first month. We would be very willing and interested to organize a meeting and discuss your ideas and projects in more detail. Please do not hesitate to write to us with any questions.

Albania has taken rapid steps in aligning its legislation with the requirements and conditions for accession to European organizations. Its acceptance as a candidate country is expected soon, and the reports prepared for this purpose have identified significant progress made by Albania in this field.

The main laws that directly affect the operation of commercial companies in Albania are as follows:

This law, together with the legal framework in this field and the related by-laws, represents one of the most important and successful steps for the operation of commercial companies and sole proprietors. The National Business Center (NBC) is the only institution responsible for business registration in the commercial register. Registration at the NBC counters, through a one-stop-shop system, is sufficient for the simultaneous registration of the commercial entity with all other related institutions (Municipality for local taxes, Tax Authorities for taxes payable, Social Insurance Institute for employees, etc.).

As of May 2022, all initial registration services and amendments at the National Business Center are carried out ONLY online.

Commercial companies must also publish in the commercial register any changes defined by this law, in addition to the initial registration.

This law primarily defines the forms of organization of commercial companies and the manner in which they are administered/governed by the company’s own bodies. The law aims to establish the framework for business organization and, depending on the form of the business, the bodies that the registered business must establish, their rights and obligations, decision-making processes, etc.

In accordance with the requirements of this law, the company defines and approves its statute, appoints the administrator, establishes other company bodies, the shareholders’ assembly, profit distribution, etc. The law incorporates best practices in this field for the protection of shareholders, creditors, and corporate governance in the future.

Albania has taken significant steps to implement a simple tax system, encouraging the spirit of self-declaration and self-calculation of taxes by taxpayers. Despite issues related to instability in fiscal legislation and frequent amendments to laws and by-laws, the tax burden applied to taxpayers and the taxes in Albania remain among the lowest in the region and represent an advantage for attracting foreign investment. The main taxes applied in the Republic of Albania are briefly as follows:

(Effective January 2024)

Corporate income tax applies to all commercial companies established under the law on entrepreneurs, including joint-stock companies and limited liability companies. Simple partnerships established under the Civil Code are also required to pay corporate income tax if they generate profits. Foreign entities operating in Albania that establish a branch or permanent establishment and generate income in the country are also subject to this tax.

Certain sectors, such as hydrocarbons, are subject to specific rules regarding profit taxation. Meanwhile, some entities are exempt from this tax but are still required to submit financial statements. These include humanitarian, charitable, and religious organizations with non-profit purposes, foundations, institutions supporting government development policies, as well as chambers of commerce and industry. Furthermore, if an entity is registered in Albania or exercises management and control in the country, it is considered an Albanian tax resident. This determination is based on key decision-making, board composition, or the percentage of capital owned by Albanian resident persons.

Taxable income includes profits from commercial operations, dividends, rents, interest, and capital gains. Regarding dividend taxation, if a company owns at least 10% of the shares in another company for a period longer than 24 months, dividend income is not included in taxable profit. If this period or ownership percentage is not met, the dividend becomes part of taxable profit and is subject to corporate income tax.

For deductible expenses, tax legislation allows the deduction of expenses directly related to economic activity, such as wages, asset depreciation, marketing costs, and ordinary business operations. However, interest expenses are deductible only up to 30% of EBITDA (earnings before interest, taxes, and depreciation), with exceptions for banks and public projects.

Another important element is the deduction of bad debts, which is allowed only if all legal procedures for their collection have been followed. Asset depreciation is calculated using the straight-line method, and asset revaluations do not affect the depreciation base. Business losses may be carried forward for five tax years, but only if more than 50% of ownership or the nature of the company’s activity has not changed.

Corporate income tax is calculated by applying the standard rate of 15% to taxable profit. However, certain sectors and industries may be subject to different rates.

For small businesses with annual revenues up to 14 million ALL, a 0% tax rate applies until 2029.

For entities generating income outside Albania, foreign tax credits are allowed, but only up to the amount that would be taxed in Albania. Corporate income tax returns must be filed by March 31 of the following year. Advance payments are made monthly or quarterly, and installments may be adjusted.

If a business anticipates significantly lower income than in previous years, it may request a reduction of advance installments. Conversely, if the tax administration determines that income has increased by more than 10% compared to the previous year, it may require an increase in installments for the last quarter of the year.

Certain sectors benefit from tax incentives. Agritourism, software production, and the automotive industry enjoy reduced tax rates until 2029. Additionally, the transfer of business assets outside Albania is taxed at 15%, based on market value at the time of transfer.

Personal income tax applies to all individuals earning income from employment, business, and investments. This includes employees, self-employed individuals, and individual entrepreneurs. The tax also applies to income from gifts, inheritance, and games of chance. An individual is considered an Albanian tax resident if they have a permanent residence, stay in Albania for more than 183 days per year, or have their center of vital interests in the country. Certain diplomatic and consular officials serving abroad are also considered Albanian tax residents.

Taxable income includes salaries, compensation, bonuses, and any other benefits received from an employment relationship. It also includes business profits, rental income, investment income, and transactions involving virtual assets. Income in kind is also taxable and is valued at market prices. Exemptions include pensions, social assistance, scholarships, compensation for former political prisoners, and certain categories of investment income. Individual entrepreneurs and self-employed persons may choose between the full accounting method or the simplified method if annual income does not exceed 10 million ALL.

The annual tax base is calculated by deducting allowable expenses and compensations from gross income. Employment income is taxed progressively as follows:

Allowable Deductions:

For business income, tax rates are 15% on net income up to 14 million ALL and 23% on amounts exceeding this threshold. Investment income is taxed at 8% for dividends and 15% for other categories.

Foreign tax credits are allowed up to the amount that would be taxed in Albania. To claim deductions, taxpayers must submit supporting documentation such as family certificates and proof of education or other eligible expenses.

The standard VAT rate in Albania is 20%. A reduced VAT rate of 6% applies to the accommodation and agriculture sectors. The VAT registration threshold is an annual turnover of 10 million ALL. Any entity may voluntarily register for VAT purposes even if it does not meet the turnover requirement, through a simple request to the tax authorities. VAT applies to the supply of goods and services to taxable persons in the Republic of Albania.

VAT returns are filed monthly, and the payable amount is calculated as the difference between VAT collected on sales and VAT paid (credited) on purchases. Recent legal changes provide relief and time limits for VAT refunds. VAT may be refunded if the VAT credit balance exceeds 400,000 ALL for three consecutive months.

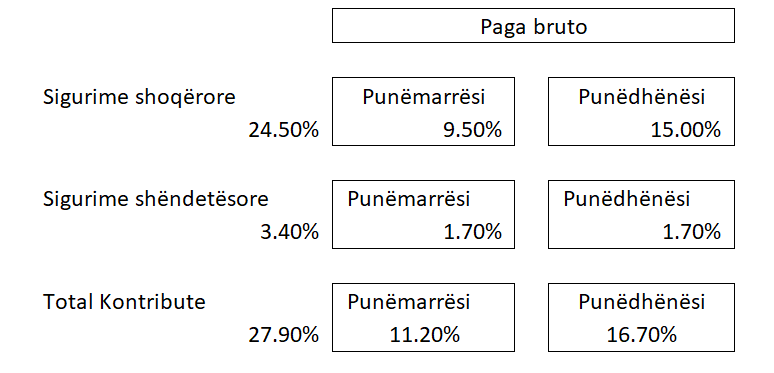

Social and health insurance contributions for company employees are calculated based on gross salary and applicable contribution rates. For each employee, the employer calculates and withholds the employee’s contributions from monthly salary, as well as pays the employer’s contributions.

Employee contributions are: Social insurance: 9.5% of salary, Health insurance: 1.7% of salary Employer contributions are: Social insurance: 15% of salary, Health insurance: 1.7% of salary

Social insurance contributions apply to a minimum base salary of 40,000 ALL and a maximum of 176,416 ALL. For salaries above the maximum, contributions are calculated on 176,416 ALL. The total social and health insurance contributions for the minimum salary amount to 11,160 ALL. Effective April 2024.

Efektive nga Janar 2026

Mandatory tax payments also include local taxes and fees payable to local government (municipality). Generally, local taxes and fees are paid once per year and are calculated based on specific criteria.

The average payable amount for most businesses registered in the city of Tirana ranges from 10,000 to 50,000 ALL per year.

Download the full information here.

Source: AlProfit Consult.

Do not hesitate to contact us. We are a team of experts and will be happy to speak with you.