Who Are We?

Alprofit Consult is an independent studio that provides accounting services, tax administration services and financial consulting services along with training services in these fields. We offer a full package of personalized professional services to businesses and individuals who wish to benefit from these services.

At AlProfit Consult, we are committed to ensuring that our clients have the resources they need to optimize their financial position and business operations. We welcome the opportunity to learn more about your financial service needs and how we can assist you.

We also invite you to benefit from our offer of providing financial consulting services free of charge for the first month. We would be very willing and interested to organize a meeting and discuss your ideas and projects in more detail. Please do not hesitate to write to us with any questions.

Main Laws for Business Registration and Administration

Albania has taken rapid steps in aligning its legislation with the requirements and conditions for accession to European organizations. Its acceptance as a candidate country is expected soon, and the reports prepared for this purpose have identified significant progress made by Albania in this field.

The main laws that directly affect the operation of commercial companies in Albania are as follows:

Law no. 9723, dated 03.05.2007 “On the National Registration Center” (most recently amended to the National Business Center).

This law, together with the legal framework in this field and the related by-laws, represents one of the most important and successful steps for the operation of commercial companies and sole proprietors. The National Business Center (NBC) is the only institution responsible for business registration in the commercial register. Registration at the NBC counters, through a one-stop-shop system, is sufficient for the simultaneous registration of the commercial entity with all other related institutions (Municipality for local taxes, Tax Authorities for taxes payable, Social Insurance Institute for employees, etc.).

- The application form at the NBC. This is the form completed at this institution where the company’s details are declared.

As of May 2022, all initial registration services and amendments at the National Business Center are carried out ONLY online.

- The company statute, which defines the company’s details (Name, Form – limited liability company, date of establishment, identification details of the founders, registered office, scope of activity, duration – if specified, administrator details, value of the share capital – minimum 100 ALL). This document does not need to be notarized.

- Authorization of the person who will perform the business registration (if different from the company administrator). This document must be notarized.

Commercial companies must also publish in the commercial register any changes defined by this law, in addition to the initial registration.

Law no. 9901, dated 14.04.2008, “On Entrepreneurs and Commercial Companies”, together with the related legal acts.

This law primarily defines the forms of organization of commercial companies and the manner in which they are administered/governed by the company’s own bodies. The law aims to establish the framework for business organization and, depending on the form of the business, the bodies that the registered business must establish, their rights and obligations, decision-making processes, etc.

In accordance with the requirements of this law, the company defines and approves its statute, appoints the administrator, establishes other company bodies, the shareholders’ assembly, profit distribution, etc. The law incorporates best practices in this field for the protection of shareholders, creditors, and corporate governance in the future.

Main Taxes Applied in Albania

Albania has taken significant steps to implement a simple tax system, encouraging the spirit of self-declaration and self-calculation of taxes by taxpayers. Despite issues related to instability in fiscal legislation and frequent amendments to laws and by-laws, the tax burden applied to taxpayers and the taxes in Albania remain among the lowest in the region and represent an advantage for attracting foreign investment. The main taxes applied in the Republic of Albania are briefly as follows:

Tatimi mbi të ardhurat (fitimin)

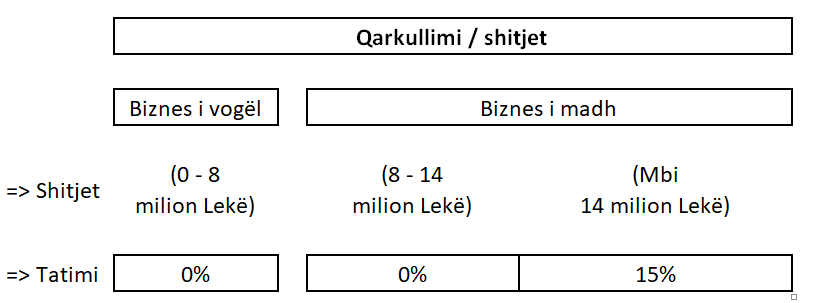

Tatimi mbi fitimin paguhet mbi fitimin e llogaritur dhe deklaruar të shoqërive dhe subjekteve të tjera në proporcion me fitimin e tatueshëm. Në Shqipëri, për qëllime të tatimit mbi fitimin, ligji i klasifikon subjektet tregtare në dy grupe, sipas skemës së mëposhtëm.

- Biznese të Mëdhaja, subjekt i aplikimit të tatimit mbi fitimin. Këtë kategori ligji e klasifikon në dy kategori; (i) Subjekte me xhiro deri në 14 milion Lekë (ose rreth 110,000 Euro) që llogarisin dhe paguajnë tatim mbi fitimin në normën 0% të fitimit të tatueshëm, dhe (ii) Biznese me xhiro mbi 14 milion Lekë (ose rreth 110,000 Euro), të cilat tatohen në normën 15% të fitimit të tatueshëm. Biznese të mëdhaja konsiderohen ato subjekte të cilat tejkalojnë kufirin e qarkullimit (shitjeve) mbi 8 milion lekë (ose rreth 65,000 Euro) në vit. Këto subjekte deklarojnë për qëllime të tatimit mbi fitimin një herë në vit brenda datës 31 Mars të vitit pasardhës.

- Biznese të vogla, subjekt i aplikimit të tatimit të thjeshtuar mbi fitimin. Subjekte me xhiro vjetore nga 0 milion lekë deri ne 8 milion lekë të cilat llogarisin dhe paguajnë tatimin e thjeshtuar mbi fitimin me normën 0 % të fitimit të tatueshëm. Afati i plotësimit të deklaratës për këtë kategoritë është data 10 Shkurt e vitit pasardhës.

Fitimi i tatueshëm përcaktohet nga fitimi kontabël i periudhës i rregulluar për qëllime të tatimi mbi të ardhurat me disa përjashtime të veçanta që lidhen me dokumentimin e shpenzimeve tatimore dhe qëllimi të kryerjes së këtyre shpenzimeve në funksion të aktivitetit të shoqërisë.

Pagesa e tatimit bëhet duke parapaguar këste paraprake mujore të tatimit, në funksion të shumës ë tatimit të paguar një vit më parë dhe nëse në fund të periudhës fiskale subjektet rezultojnë me fitim më të madh paguhet diferenca me plotësimin e deklaratës vjetore të tatimit mbi fitimin, në të kundërt pagesa e kryer më tepër ose rimbursohet ose kalohet për pagesën e detyrimeve të tjera tatimore në të ardhmen. Në këtë fushë ligji lejon subjektet të parashikojnë fitimin e tatueshëm dhe të argumentojnë pranë organeve tatimore kërkesën për uljen e kësteve paraprake të tatimit mbi fitimin.

Të gjitha të ardhurat e tjera tatohen me normën 15%, me përjashtim të tatimit mbi dividentin që tatohen në normën 8%. Këtu përfshihen të gjitha të ardhurat e tjera, që nuk përfshihen në dy kategoritë e mësipërme. P.sh. të ardhurat nga qiraja tatohen në normën 15%.

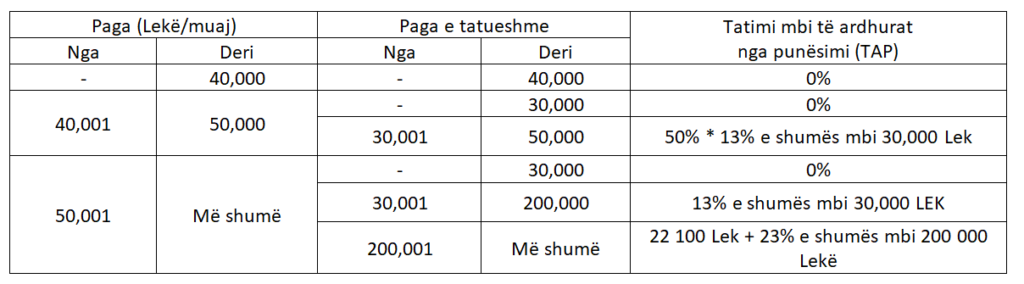

Gjithashtu punonjësit tatohen për ardhurat nga paga (TAP) e cila llogaritet në funksion të pagës bruto dhe normës progresive të tatimit si vijon.

Tatimi mbi pagën paguhet nga i punësuari dhe ky tatim mblidhet nga punëdhënësi.

Value Added Tax (VAT)

The standard VAT rate in Albania is 20%. A reduced VAT rate of 6% applies to the accommodation and agriculture sectors. The VAT registration threshold is an annual turnover of 10 million ALL. Any entity may voluntarily register for VAT purposes even if it does not meet the turnover requirement, through a simple request to the tax authorities. VAT applies to the supply of goods and services to taxable persons in the Republic of Albania.

VAT returns are filed monthly, and the payable amount is calculated as the difference between VAT collected on sales and VAT paid (credited) on purchases. Recent legal changes provide relief and time limits for VAT refunds. VAT may be refunded if the VAT credit balance exceeds 400,000 ALL for three consecutive months.

Social and Health Insurance Contributions

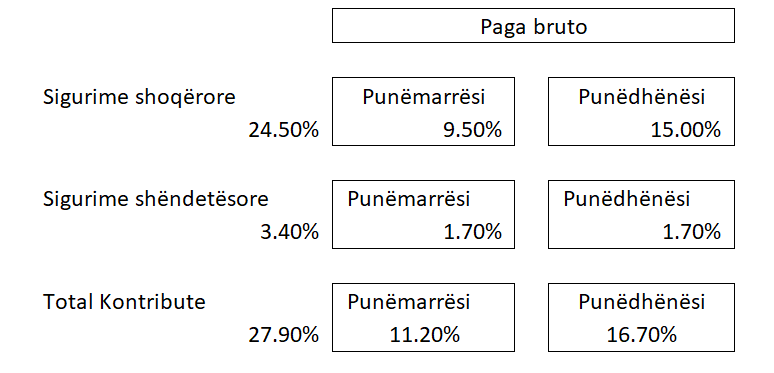

Social and health insurance contributions for company employees are calculated based on gross salary and applicable contribution rates. For each employee, the employer calculates and withholds the employee’s contributions from monthly salary, as well as pays the employer’s contributions.

Employee contributions are: Social insurance: 9.5% of salary, Health insurance: 1.7% of salary Employer contributions are: Social insurance: 15% of salary, Health insurance: 1.7% of salary

Kontributet për sigurime shoqërore aplikohen mbi pagën bazë për minimumin aktual 32,000 Lekë dhe maksimal 141,133 Lekë. Për paga mbi pagën maksimale kontributet me sigurimeve shoqërore aplikohen mbi pagën 141,133 Lekë. Shuma e sigurimeve shoqërore dhe shëndetësore për pagën minimale është 8,928 Lekë.

Local Taxes and Fees

Mandatory tax payments also include local taxes and fees payable to local government (municipality). Generally, local taxes and fees are paid once per year and are calculated based on specific criteria.

The average payable amount for most businesses registered in the city of Tirana ranges from 10,000 to 50,000 ALL per year.

Download the full information here.

Source: AlProfit Consult.